Finding the sweet spot

Meet Jenny Patrick, Meet Mindset Mastery Graduate Jenny Patrick. Jenny first went through a Guided Mindset Mastery course, and later joined me in

Meet Jenny Patrick, Meet Mindset Mastery Graduate Jenny Patrick. Jenny first went through a Guided Mindset Mastery course, and later joined me in

First, a little back story. As my husband and I were recovering from the Great Recession of 2008, I felt a compelling need

Meet Emmy Lyn Amick. Emmy started her Rare Faith study by requesting the Jackrabbit Factor ebook back in 2018. In 2020 she decided to

Are you dreaming of buying a home of your own? Today’s Q/A comes from a reader who is worried about buying a home before

Are you feeling fenced in, or trapped in an unbearable situation? You might not be as stuck as you think. Read the following, from

We’re thrilled to be introducing Elizabeth Murphy as a Mindset Mastery Honors Graduate! Liz has made a tremendous contribution to the Rare Faith community

Here’s a fun letter from one of my readers, describing what she’s learned about predicting the future: Hi Leslie… I wanted to share with

Meet Brytt Cloward. The first time I met Brytt was at a Genius Bootcamp. His questions revealed an analytical mind, and his scrutiny of

Meet Christy Lee. Christy introduced herself to our community back when she began her Mindset Mastery journey. In her words: I wanted to introduce

Funny story and small world. I need to capture this because… It’s almost stranger than fiction, plus I want to help you know what’s

Throwback time! This is my friend Linda and I in 2010. She was attending our Mentor Training program, and later shared an experience that proves “the solution

Meet Cosette Snarr. It’s been my pleasure to work with Cosette both on her incredible book about overcoming some of the most difficult marriage

By Cosette Snarr Twenty years ago I was miserable and could see no way out of my situation. My husband had uncontrolled epilepsy and

Meet Sarah Young. In the few months I’ve become acquainted with Sarah, I’ve come to know her as a woman who takes her challenges

“I saw a young lady post on the Mindset Mastery group about how she …had strived to manifest a hundred dollars in her life,

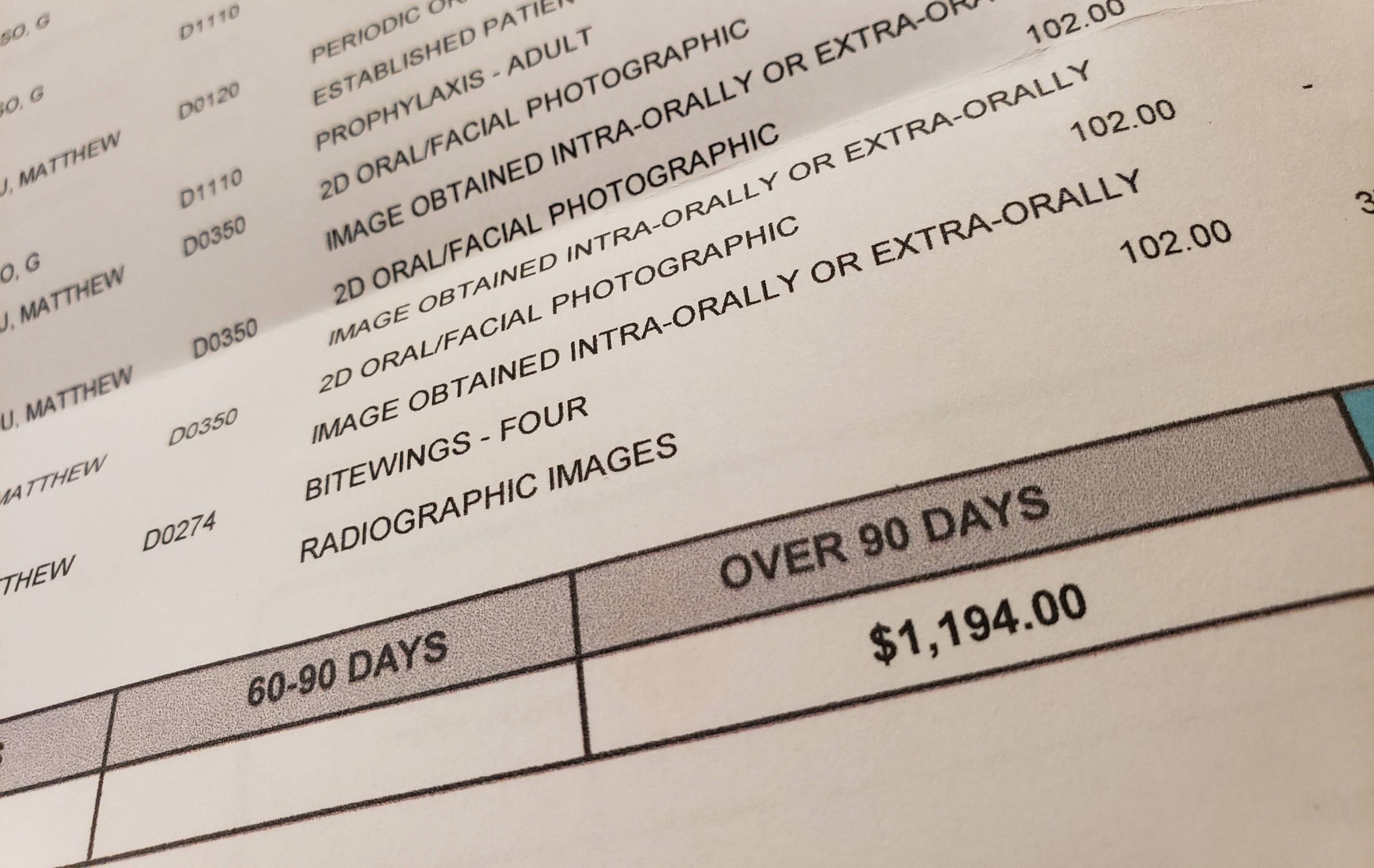

I spent the weekend battling an anxious knot in my stomach because of this dentist bill showing $1194.00 as being overdue for over 90

The Impossible House Meet Wendy Bowers. Wendy worked hard to get through the Mindset Mastery course and reaped the benefits of each experiment, but

Meet Matthew Pilling. Matthew is kind of a trouble maker, the kind we love to keep around. Leave it to Matthew to crack the

Meet Jenny Patrick, Meet Mindset Mastery Graduate Jenny Patrick. Jenny first went through a Guided Mindset Mastery course, and later joined me in

First, a little back story. As my husband and I were recovering from the Great Recession of 2008, I felt a compelling need

Meet Emmy Lyn Amick. Emmy started her Rare Faith study by requesting the Jackrabbit Factor ebook back in 2018. In 2020 she decided to

Are you dreaming of buying a home of your own? Today’s Q/A comes from a reader who is worried about buying a home before

Are you feeling fenced in, or trapped in an unbearable situation? You might not be as stuck as you think. Read the following, from

We’re thrilled to be introducing Elizabeth Murphy as a Mindset Mastery Honors Graduate! Liz has made a tremendous contribution to the Rare Faith community

Here’s a fun letter from one of my readers, describing what she’s learned about predicting the future: Hi Leslie… I wanted to share with

Meet Brytt Cloward. The first time I met Brytt was at a Genius Bootcamp. His questions revealed an analytical mind, and his scrutiny of

Meet Christy Lee. Christy introduced herself to our community back when she began her Mindset Mastery journey. In her words: I wanted to introduce

Funny story and small world. I need to capture this because… It’s almost stranger than fiction, plus I want to help you know what’s

Throwback time! This is my friend Linda and I in 2010. She was attending our Mentor Training program, and later shared an experience that proves “the solution

Meet Cosette Snarr. It’s been my pleasure to work with Cosette both on her incredible book about overcoming some of the most difficult marriage

By Cosette Snarr Twenty years ago I was miserable and could see no way out of my situation. My husband had uncontrolled epilepsy and

Meet Sarah Young. In the few months I’ve become acquainted with Sarah, I’ve come to know her as a woman who takes her challenges

“I saw a young lady post on the Mindset Mastery group about how she …had strived to manifest a hundred dollars in her life,

I spent the weekend battling an anxious knot in my stomach because of this dentist bill showing $1194.00 as being overdue for over 90

The Impossible House Meet Wendy Bowers. Wendy worked hard to get through the Mindset Mastery course and reaped the benefits of each experiment, but

Meet Matthew Pilling. Matthew is kind of a trouble maker, the kind we love to keep around. Leave it to Matthew to crack the

Let me help you crush every challenge, achieve every goal, and vanquish every monster under your bed:

Let me show you how to use the kind of faith that causes things to happen in finances, marriage, and parenting.

You’ll receive a weekly Newsletter, Podcast, and monthly Digest with fresh articles, special offers, and more! Serving over 50,000 subscribers since 2002, but don’t worry – It’s easy to cancel at any time with just one click.